> At a Glance

> – Warner Bros. Discovery board rejected Paramount’s $77.9 billion hostile takeover offer

> – Company urges shareholders to accept Netflix’s $72 billion bid for streaming and studio assets

> – Shareholders have until Jan. 21 to tender shares

> – Why it matters: The decision shapes the future of major entertainment assets including HBO Max and CNN

Warner Bros. Discovery doubled down on its support for Netflix’s acquisition offer, formally rejecting a richer bid from Paramount that would swallow the entire company.

The Board’s Decision

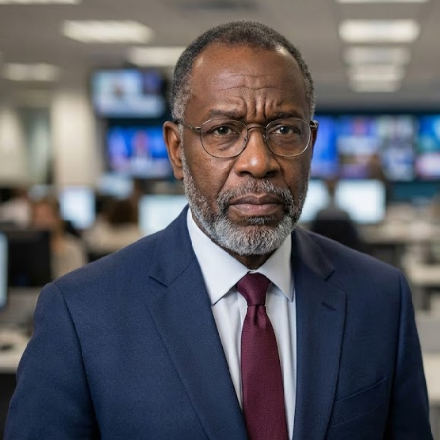

The Warner Bros. Discovery board unanimously ruled that Paramount’s offer fails to serve shareholder interests. Chair Samuel Di Piazza Jr. warned the deal carries excessive debt and weak protections.

> “Paramount’s offer continues to provide insufficient value, including terms such as an extraordinary amount of debt financing that create risks to close and lack of protections for our shareholders if a transaction is not completed,” Samuel Di Piazza Jr. stated.

He contrasted this with the Netflix agreement, which he said “will offer superior value at greater levels of certainty.”

Competing Visions

The two suitors want markedly different parts of Warner:

- Netflix: Offers $72 billion for studio and streaming business only (HBO Max, production arms)

- Paramount: Bids $77.9 billion for the entire company, including CNN and Discovery networks

If Netflix wins, Warner’s news and cable operations would become a separate company.

Sweetened Offer Falls Short

Paramount tried to bolster its bid late last month by:

- Securing Larry Ellison’s personal guarantee for $40.4 billion in equity

- Matching Netflix’s $5.8 billion regulatory breakup fee

Warner still balked, calling the proposal essentially a leveraged buyout with operating restrictions that could “hamper WBD’s ability to perform.”

Regulatory Hurdles Ahead

Either deal faces intense scrutiny:

| Review Body | Timeline | Potential Action |

|---|---|---|

| U.S. Justice Department | 12+ months | Sue to block or demand changes |

| International regulators | Varies | Challenge merger |

| Congressional committees | Ongoing | Hold hearings |

Cinema United, representing 60,000+ movie screens worldwide, told Congress both deals could harm theaters, workers, and filmmaking diversity.

Labor Opposition

Major Hollywood unions oppose both transactions:

- SAG-AFTRA released statements against the proposals

- Writers’ Guild of America echoed concerns

Key Takeaways

- Warner shareholders must choose by January 21

- Netflix offers less money but greater certainty

- Paramount pays more but adds heavy debt

- Either path triggers extensive antitrust review

- Politics may play a role under the Trump administration

With the clock ticking, Warner investors must decide whether to back the smaller but cleaner Netflix deal or risk the complexities of Paramount’s full-company takeover.