At a Glance

- Trump’s takeover plan for Venezuela’s oil industry faces political uncertainty and huge investment needs.

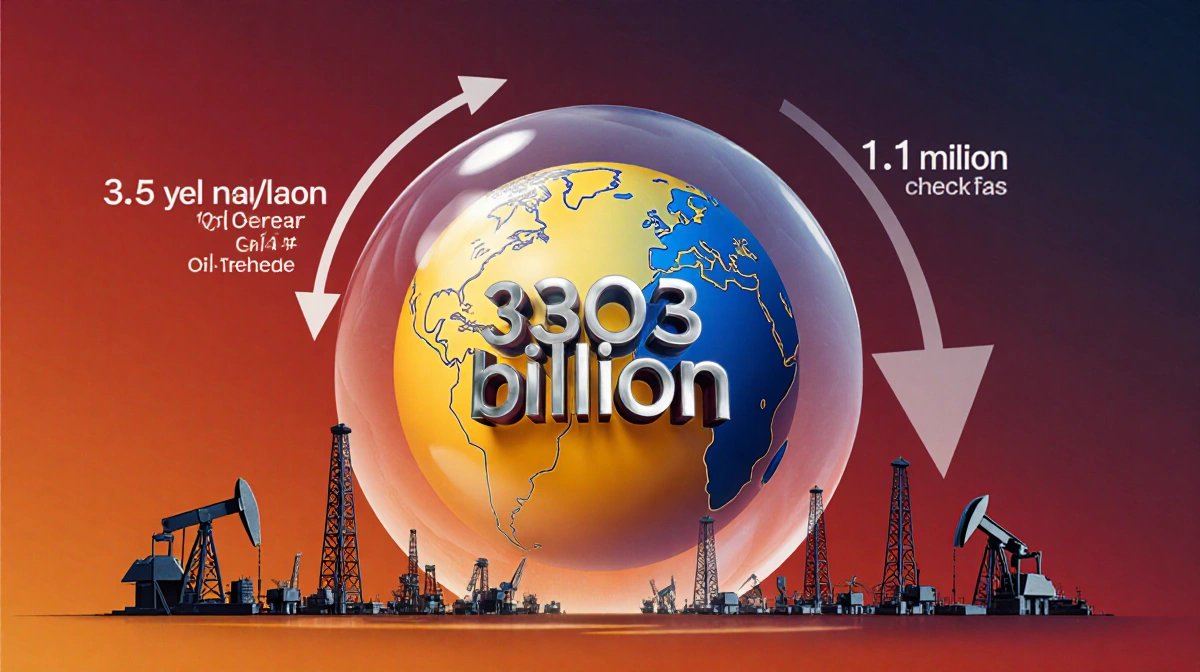

- Analysts see potential to triple output from 1.1 million barrels per day to historic levels.

- Current production is under 1% of global supply, with sanctions and mismanagement cutting output.

- Why it matters: The move could reshape global oil prices and shift power away from Russia.

The United States has announced a plan to seize control of Venezuela’s oil sector after a raid on President Nicolás Maduro, but the strategy is unlikely to move markets immediately.

Political Uncertainty and Investment Hurdles

Patrick De Haan said:

> “While many are reporting Venezuela’s oil infrastructure was unharmed by U.S. military actions, it has been decaying for many many years and will take time to rebuild.”

Phil Flynn added:

> “But if it seems like the U.S. is successful in running the country for the next 24 hours, I would say there would be a lot of optimism that U.S. energy companies could come in and revitalize the Venezuelan oil industry fairly quickly.”

- Exxon Mobil: no comment

- ConocoPhillips: monitoring developments

- Chevron: operating 250,000 barrels per day via PDVSA

Oil Reserves, Production, and Market Impact

Venezuela holds 303 billion barrels of proven reserves, roughly 17% of global oil. Production has fallen from 3.5 million barrels per day in 1999 to about 1.1 million barrels today.

| Metric | Current | Potential |

|---|---|---|

| Production (barrels/day) | 1.1 million | 4 million |

| Reserves (barrels) | 303 billion | 303 billion |

| Investment needed | – | $100 billion |

Bill Turenne said:

> “Chevron remains focused on the safety and wellbeing of our employees, as well as the integrity of our assets. We continue to operate in full compliance with all relevant laws and regulations.”

Matthew Waxman warned:

> “For example, a big issue will be who really owns Venezuela’s oil? An occupying military power can’t enrich itself by taking another state’s resources, but the Trump administration will probably claim that the Venezuelan government never rightfully held them.”

Key Takeaways

- The plan faces political uncertainty and requires a stable regime for investment.

- Venezuela’s massive reserves could triple output, but would need $100 billion over a decade.

- A successful revival could lower global oil prices and reduce dependence on Russian diesel.

The outcome of Trump’s initiative remains tied to political stability and the willingness of U.S. firms to commit capital to a heavily sanctioned and deteriorated oil sector.