At a Glance

- General Fusion plans a reverse merger with Spring Valley III that could bring up to $335 million into the company.

- The deal values the combined company at roughly $1 billion after a $22 million lifeline last year.

- The company’s LM26 reactor uses steam-driven pistons to compress a fuel pellet, aiming for scientific breakeven by 2026.

Why it matters: The move could accelerate fusion’s path to commercial power and tap into a growing market for clean energy.

—

General Fusion’s recent announcement marks a dramatic turnaround after a year of financial distress. After laying off at least 25 % of its staff and securing a $22 million lifeline, the company is now set to go public through a reverse merger with Spring Valley III, a specialist in energy-sector mergers. The deal could inject up to $335 million and value the combined entity at about $1 billion.

From Struggle to Survival

Last year, General Fusion faced a funding crisis that forced it to cut a quarter of its workforce. The startup’s CEO issued a public plea for capital, a move that highlighted the urgency of its technology’s commercial viability. A private investment of $22 million helped keep the company afloat, but the cash flow remained tight.

| Year | Milestone | Funding | Notes |

|---|---|---|---|

| 2002 | Founded | – | – |

| 2022 | First major raise | – | – |

| 2023 | 25 % staff layoffs | – | – |

| 2024 | $22 M lifeline | $22 M | Private investment |

| 2025 | Reverse merger announced | Up to $335 M | With Spring Valley III |

The Reverse Merger Plan

The reverse merger with Spring Valley III is a strategic choice that bypasses a traditional IPO. Spring Valley has a track record of taking energy companies public, having previously merged NuScale Power and is finalising a deal with Eagle Energy Metals. The transaction will bring in institutional investors and could raise $335 million, more than double the amount General Fusion sought before the lifeline.

Key points of the deal:

- Valuation: Roughly $1 billion for the combined company.

- Capital raise: Up to $335 million.

- Timing: Closing expected within the next 12 months.

- Investor mix: Institutional and private investors, alongside Spring Valley’s existing shareholder base.

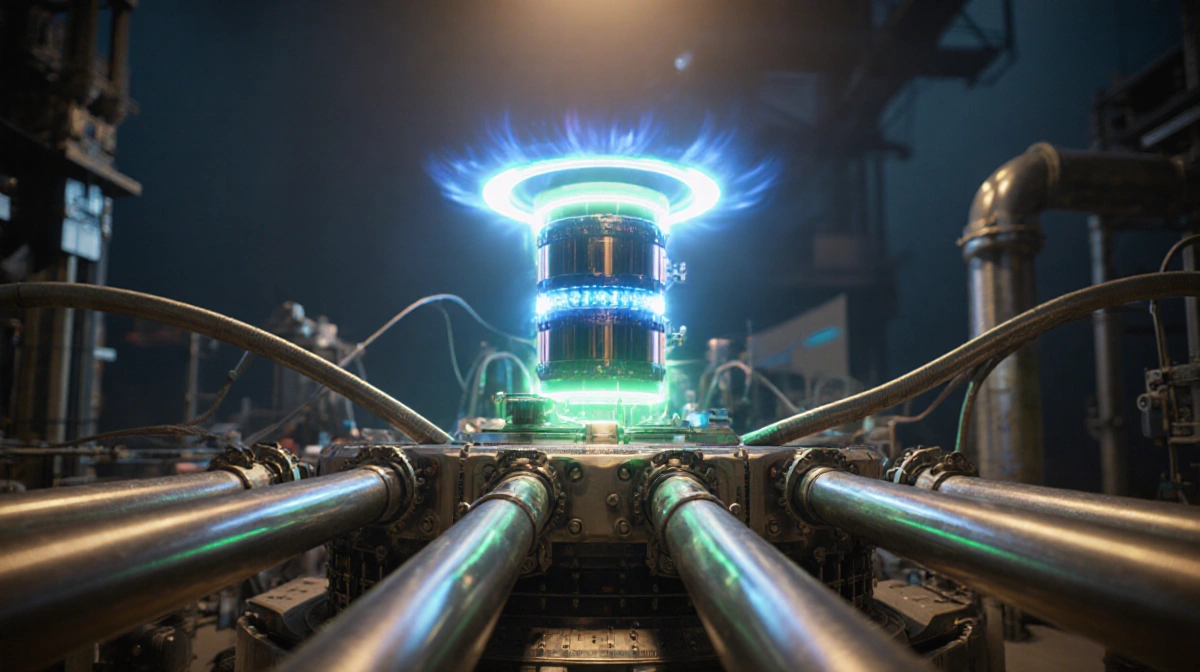

The LM26 Reactor and Fusion Technology

Central to General Fusion‘s strategy is the Lawson Machine 26 (LM26). Unlike traditional inertial confinement fusion that relies on high-energy lasers, LM26 compresses a fuel pellet using steam-driven pistons that push liquid lithium inward. The lithium circulates through a heat exchanger, generating steam to spin a generator. This approach eliminates the need for costly lasers or superconducting magnets.

| Feature | Traditional Inertial Confinement | LM26 Steam-Driven Design |

|---|---|---|

| Energy source | Lasers | Steam-pistons |

| Key component | Laser system | Liquid lithium wall |

| Cost driver | Lasers, optics | Lithium, pistons |

| Target milestone | Scientific breakeven by 2026 | Scientific breakeven by 2026 |

General Fusion stated that LM26 could reach scientific breakeven-where the fusion reaction outputs more energy than is required to start it-by 2026. The company has not confirmed whether its timeline has shifted.

Market Context and Future Demand

The merger announcement cites rising energy demand from data centers, which are projected to consume nearly 300 % more power by 2035. General Fusion also points to broader electrification trends-electric vehicles and heating-that could raise overall electricity demand by up to 50 % by 2035. These trends suggest a sizable market for clean, low-cost fusion once the technology proves viable.

Other fusion players have pursued public listings recently. TAE Technologies merged with Trump Media & Technology Group in a deal valuing the combined company at more than $6 billion. These moves underscore a growing appetite for fusion assets among investors.

Key Takeaways

- General Fusion is pivoting from a cash-strapped startup to a public company via a reverse merger with Spring Valley III.

- The deal could bring $335 million into the company and value it at about $1 billion.

- The LM26 reactor’s steam-driven design offers a potentially cheaper path to fusion, aiming for scientific breakeven by 2026.

- Rising data-center and electrification demand could provide a ready market for fusion power once the technology matures.

—

This article is based solely on the information provided and does not include any additional context beyond the supplied facts.