Inflation in November fell to 2.7%, the Bureau of Labor Statistics said Thursday, a positive sign for consumers on its face.

CPI Release After the Shutdown

The figures released on Thursday were the first batch of inflation data to be published since the historically‑long government shutdown ended in mid‑November. Because the data for October was not collected during the 43‑day shutdown, the BLS had to make a number of adjustments to generate the November numbers. The change for the two months of October and November was 0.2%, a figure the BLS typically doesn’t release. Analysts and economists surveyed by Dow Jones had expected inflation to rise to 3.1% in November, so 2.7% was broadly considered good news for consumers.

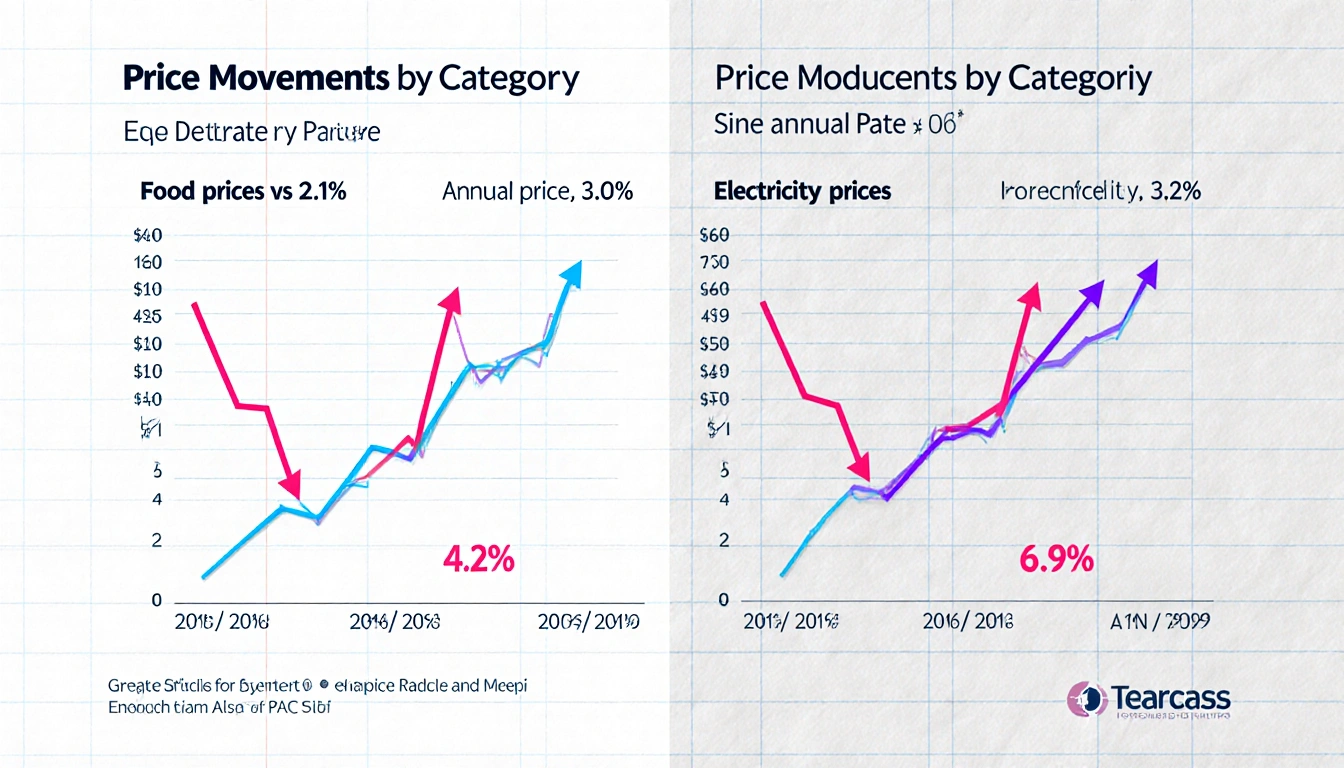

Price Movements by Category

The most significant easing in prices occurred in the categories of food and what the BLS calls “shelter,” which includes both rent and mortgages. In September, prices in the food category were rising at a 3.1% annual rate. In Tuesday’s release that slowed to 2.6%. Housing was increasing at an annual rate of 3.6% in September. In November, that slowed to 3.0%. Energy prices, however, have risen 4.2% over the last 12 months. The index for electricity increased 6.9% over the last 12 months.

Market Reaction

The data, which could be a green light for the Fed to continue interest rate cuts, initially sent stock futures soaring and bond yields tumbling. S&P 500 futures rose nearly 1% and Nasdaq 100 futures jumped more than 1.3%, as of 8:40 a.m. ET. The release also sparked a sharp rally in the bond market, with yields falling as investors priced in the possibility of further easing.

Fed Implications

During the shutdown, BLS employees did not collect all the data needed to determine how prices had changed over October, and the agency later confirmed it would not release an October inflation report. Despite the October data gap, the Federal Reserve announced last week that it would cut borrowing costs by a quarter of a percentage point. The decision was driven by concerns about the labor market, which has shown signs of weakening in recent weeks. On Tuesday, BLS released new data showing job cuts jumped in October, pushing the unemployment rate up to 4.6% last month. Asked about persistent inflation at a news conference in Washington, Federal Reserve Chair Jerome Powell pointed to President Donald Trump’s trade policy, saying, “It’s really tariffs that’s causing the most of the inflation overshoot.”

Public Concern

Americans consistently report that inflation and everyday costs are the most pressing economic issues they face: 44% of adults chose “inflation and the rising cost of living” as their top concern in an NBC Decision Desk poll released Sunday.

Key Takeaways

- November CPI dropped to 2.7%, below the 3.1% forecast.

- Food and shelter prices eased, while energy remained high.

- The release triggered a rally in stock futures and a drop in bond yields.

- The Fed may continue rate cuts as the labor market shows signs of weakness.

- Public concern over inflation remains high, with nearly half of adults citing it as a top issue.

The first post‑shutdown inflation data signals a softer price environment for consumers, while also providing the Federal Reserve with additional evidence to consider further monetary easing. Investors and policymakers will keep a close eye on how the remaining data from the shutdown period might shift the overall picture of inflation moving forward.