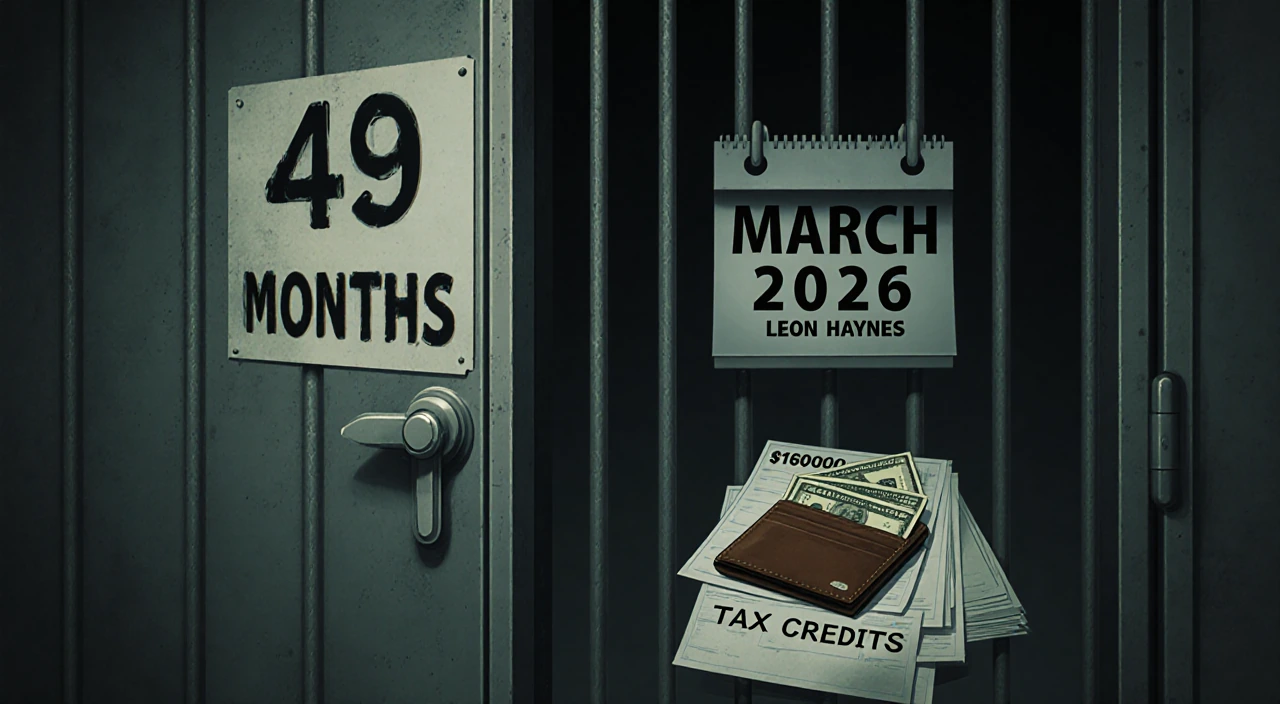

A New Jersey man was sentenced to 49 months in prison after pleading guilty to two separate schemes that siphoned hundreds of thousands of dollars from the U.S. government and an elderly customer.

James J. Mastrogiovanni, 45, was the defendant in the case that led to the lengthy sentence.

During the COVID-19 pandemic, from March 2021 to December 2022, Mastrogiovanni collaborated with tax preparer Leon Haynes.

Together they filed forms with the IRS claiming that Mastrogiovanni and his family members operated small businesses that required assistance.

The claim was false because neither Mastrogiovanni nor his relatives owned any businesses or employed staff.

Despite the lack of legitimate business activity, the fraudulent filings earned Mastrogiovanni over $1,443,409 in tax credits.

In addition, the scheme extracted $545,692 from the Treasury through the same deceptive tax return filings.

From June through December 2023, Mastrogiovanni targeted an 85‑year‑old customer at a dealership where he worked.

The victim used a check to pay for a car, and Mastrogiovanni used the routing and checking account numbers from that check.

He conducted purchases without the customer’s knowledge or approval, draining the account until it ran out of money.

The total amount stolen from the elderly customer exceeded $180,000.

Mastrogiovanni was charged with conspiracy to defraud the United States, mail fraud, money laundering, and related offenses.

He pleaded guilty to all of the charges in a federal court proceeding.

The judge imposed a sentence of 49 months in prison, followed by three years of supervised release.

The sentence also required Mastrogiovanni to pay restitution totaling $726,862.

Leon Haynes, the tax preparer who assisted Mastrogiovanni during the pandemic, faced his own legal consequences.

A jury found Haynes guilty of aiding and assisting in the preparation and presentation of false tax returns, mail fraud, and other related charges.

Haynes is scheduled to be sentenced on March 12, 2026.

The victims of Mastrogiovanni’s schemes suffered significant financial losses.

The federal government recovered a portion of the funds through the restitution order.

The case illustrates the seriousness of fraud involving tax credits and elder financial exploitation.

Federal prosecutors emphasized that the defendants’ actions violated multiple statutes designed to protect taxpayers and vulnerable citizens.

Law enforcement agencies worked together to uncover the fraudulent activities and build the case.

The prosecution relied on documentation of the false tax filings and records of the check‑based theft.

Both defendants’ cooperation in pleading guilty helped shape the final sentencing outcomes.

The court’s decision underscores the importance of vigilance against fraudulent claims and elder abuse.

The community and victims are encouraged to report suspicious financial activity to authorities.

In closing, the sentence serves as a reminder that the legal system will hold individuals accountable for exploiting public resources and trusting citizens.

Key Takeaways

- Mastrogiovanni received a 49‑month prison term for tax credit fraud and elder theft.

- He earned over $1.4 million in false tax credits and stole more than $180,000 from an elderly customer.

- Leon Haynes, his tax‑preparer partner, faces sentencing in March 2026.

The case highlights the need for stringent oversight of tax filings and protection for vulnerable consumers.