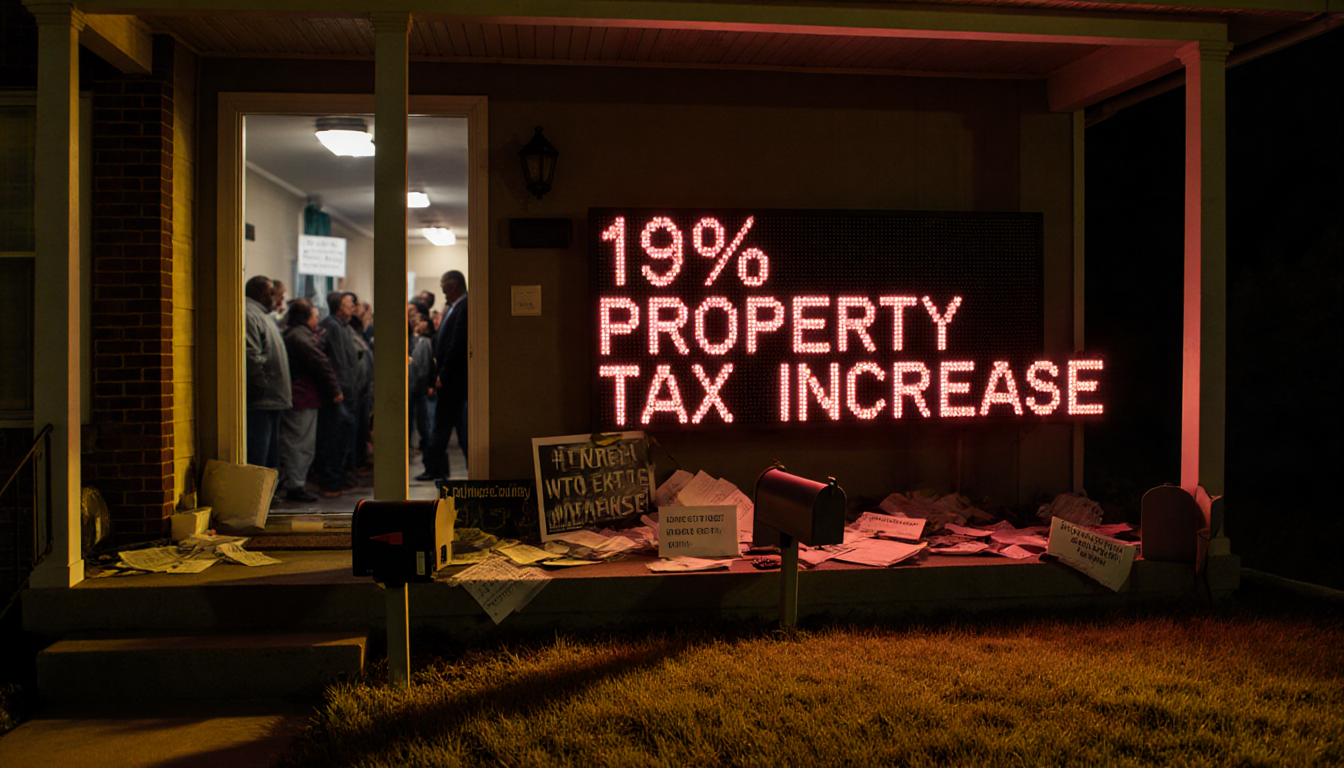

Delaware County residents were stunned Monday as council members approved a 19% property tax increase that will add roughly $16 a month to homeowners’ bills.

Council Decision and Vote

The Delaware County Council voted 4‑1 to raise property taxes by 19% on Wednesday night. The decision followed a 23% increase approved for 2025. The vote was held in the county’s council chamber, with a small audience of local residents and media.

Financial Rationale

Council officials cited a current financial deficit, the depletion of federal COVID relief funds, and inflation as key reasons for the hike. They emphasized that the county’s budget is at risk of running out of money without the additional revenue. The council’s financial report shows a shortfall that cannot be bridged by other revenue sources.

Council Member Perspective

Kevin Madden, one of the council members who voted for the increase, said, “Even though I’m voting for this, I will apologize to the taxpayers that we have to, but we do,” during the public briefing. He added, “Our primary responsibility is to make sure this county is on solid ground, and make no mistake, in absence of this increase tonight, we would run out of money.” Madden stressed that the decision was a necessity rather than a choice.

Resident Voices

One resident at the meeting before the vote remarked, “Homeowners and taxpayers can’t take much more of these taxes,” expressing frustration with the new burden. Another resident said, “A lot of people are frustrated. A lot of people aren’t happy with this tax increase, especially we begged you guys not to do it, and you went the other way.” These comments illustrate the community’s opposition to the hike.

Community Reaction

The meeting drew a crowd of residents who expressed concerns about the impact on their monthly budgets. Some participants highlighted the difficulty of balancing household expenses with the new tax burden. Others called for alternative solutions that would not raise property taxes.

NBC Coverage

NBC10’s Shaira Arias reported on the event, noting that the council’s decision was met with strong opposition from local voters. Arias covered the council’s explanation of the financial deficit and the need for the increase. The station’s report emphasized the residents’ reaction during the public session.

Impact on Homeowners

The 19% increase will raise the average homeowner’s monthly property tax by about $16. This figure was derived from the council’s projected revenue and the total number of assessed properties. Homeowners who already face tight budgets are likely to feel the strain.

Potential Future Actions

Council members indicated that the increase is intended to stabilize the county’s finances for the next fiscal year. They did not announce any immediate plans to reduce the tax rate or cut services. Residents have requested more transparency regarding how the additional funds will be allocated.

Financial Context

The 2025 budget included a 23% property tax increase, which was also approved by the council. That earlier hike was meant to address a different set of financial challenges, including infrastructure maintenance. The current 19% hike builds on the previous increase to cover new deficits.

Federal COVID Relief

The depletion of federal COVID relief funds was cited as a major factor in the council’s decision. These funds, which were earmarked for pandemic recovery, have been exhausted over the past two years. The council argued that without these funds, the county cannot meet its obligations.

Inflation Impact

Inflation has contributed to higher operating costs for county services such as road maintenance and public safety. The council reported that rising prices have strained the budget, necessitating additional revenue. They suggested that the tax increase would help offset these inflationary pressures.

Council Explanation

During the public session, council members reiterated that the increase was a last resort. They emphasized that keeping the county on solid ground required this step. The council’s financial statements show a projected budget surplus if the increase is implemented.

Resident Sentiment

Many residents expressed anger at the decision, feeling that the county had failed to find alternative solutions. Some residents suggested that the county should explore cost‑cutting measures before raising taxes. Others expressed concern about the long‑term impact on property values.

Key Takeaways

- Delaware County approved a 19% property tax increase, adding roughly $16/month on average.

- The hike follows a 23% increase for 2025 and is driven by a budget deficit, depleted COVID funds, and inflation.

- Residents voiced strong opposition, citing financial strain and a desire for alternative solutions.

The council’s decision marks a significant shift in Delaware County’s fiscal policy, with potential ripple effects on homeowners and community services. Residents will continue to monitor how the additional revenue is utilized and whether further adjustments are necessary.