> At a Glance

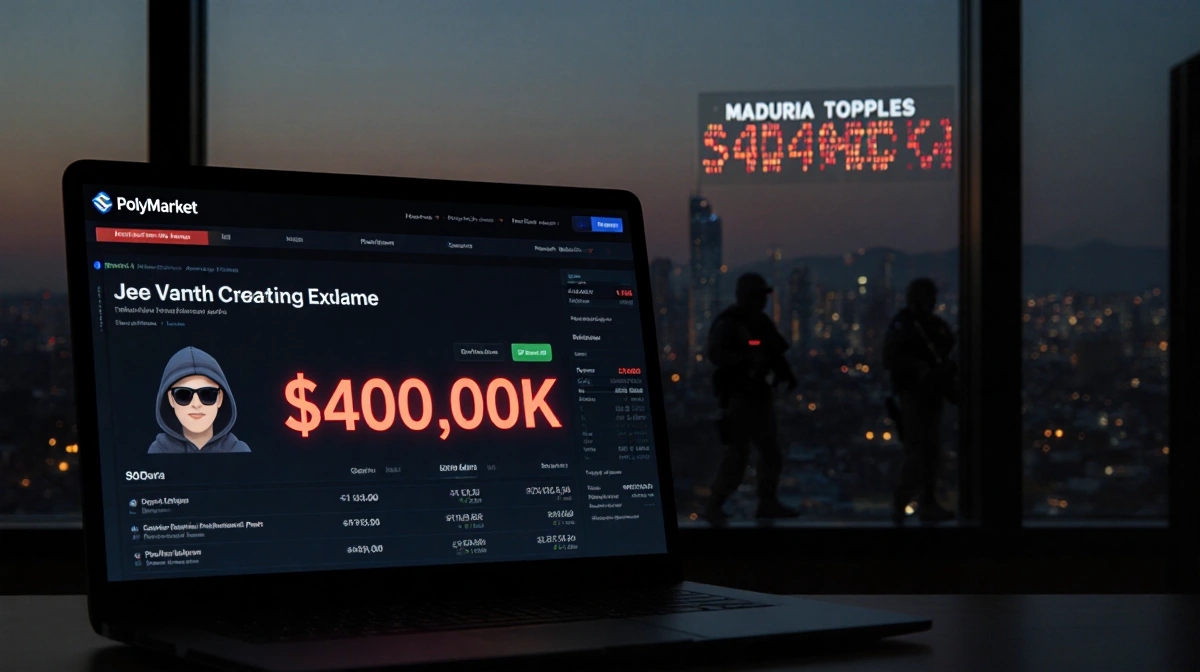

> – A Polymarket user turned $34K into $400K by betting the U.S. would topple Maduro

> – The final $14K wager landed hours before Saturday’s special-forces capture

> – The account cashed out in Solana through a major U.S. exchange with no attempt to hide

> – Why it matters: The timing raises fresh fears that classified war plans can be monetized on public crypto markets

Hours before U.S. special forces swooped into Caracas, an anonymous Polymarket trader staked $14,000 on the collapse of Nicolás Maduro’s regime-completing a 13-bet winning streak that pocketed more than $400,000.

The Winning Streak

Every wager was placed between Dec. 27 and Jan. 3, all tied to two linked outcomes: a U.S. invasion of Venezuela and Maduro’s removal from power. The account risked a total of $33,934.34 across those bets.

Polymarket shows no sign the trader tried to mask activity:

- Winnings withdrawn in Solana via a major American exchange

- No mixing or laundering steps detected, per Chainalysis

- Account geolocation and identity remain unknown

Operation Secrecy

President Trump declared in early December that Maduro’s days were “numbered,” yet only a tight circle knew the final go-date. Administration officials told News Of Philadelphia the president signed the order before Christmas but kept the exact hour fluid; Pentagon leaders learned the launch time late Friday night.

The bettor’s largest wager hit the market that same Friday night, minutes before the strike team departed.

Other Suspicious Wins

At least four additional accounts bet solely on Maduro leaving office by Jan. 31, each risking between $700 and $900 between Thursday and Saturday. All cleared $7,000-$14,000 when the market resolved “yes.” There is no public evidence these users had advance knowledge.

New Legal Crosshairs

Prediction markets occupy a gray zone. Polymarket once barred Americans under CFTC pressure, but the agency dropped its probe last summer and approved the site as a U.S. exchange in November.

Rep. Ritchie Torres, D-N.Y., will introduce the Public Integrity in Financial Prediction Markets Act of 2026 this week, aiming to criminalize trading on non-public information.

David Chase, ex-SEC attorney, noted insider trading in commodities is usually fraud, “but the courts are going to have to catch up to this, as they typically do.”

Key Takeaways

- One crypto wallet multiplied a $34K outlay into $400K on the exact timing of a classified raid

- The trader cashed out openly, making tracing straightforward for investigators

- Congress is preparing a bill to outlaw profiting from hidden government plans on betting sites

- Polymarket now operates with CFTC approval while still asking new users to confirm they are “not a U.S. person”

Whether the jackpot stemmed from astonishing luck or a leak, the episode spotlights how national-security secrets can become tradable assets in the booming prediction-market economy.