At a Glance

- China will allow digital yuan users to earn interest from January 1.

- Current interest on traditional Chinese bank deposits is about 0.05%.

- Stablecoins can offer rewards of up to 6%.

- Why it matters: The new policy could shift competition between the digital yuan and high-yield stablecoins.

China’s decision to let digital yuan holders earn interest is aimed at boosting adoption of its central bank digital currency (CBDC). Starting January 1, the digital yuan will have the same legal status as traditional deposits in the commercial banking system. The move follows a decade-long trial that began in 2014 and is part of the Chinese Communist Party’s five-year economic plan.

Interest on Digital Yuan Begins January 1

The new interest policy places digital yuan on equal footing with traditional deposits, but banks currently offer only about 0.05% on these accounts. This low rate may limit the policy’s impact, especially when compared to the rewards available in the crypto space.

- Alipay and WeChat dominate the domestic payment market.

- Binance and Kraken provide up to 6% annual rewards on stablecoin deposits.

- The digital yuan is not yet available on public blockchain networks, limiting DeFi participation.

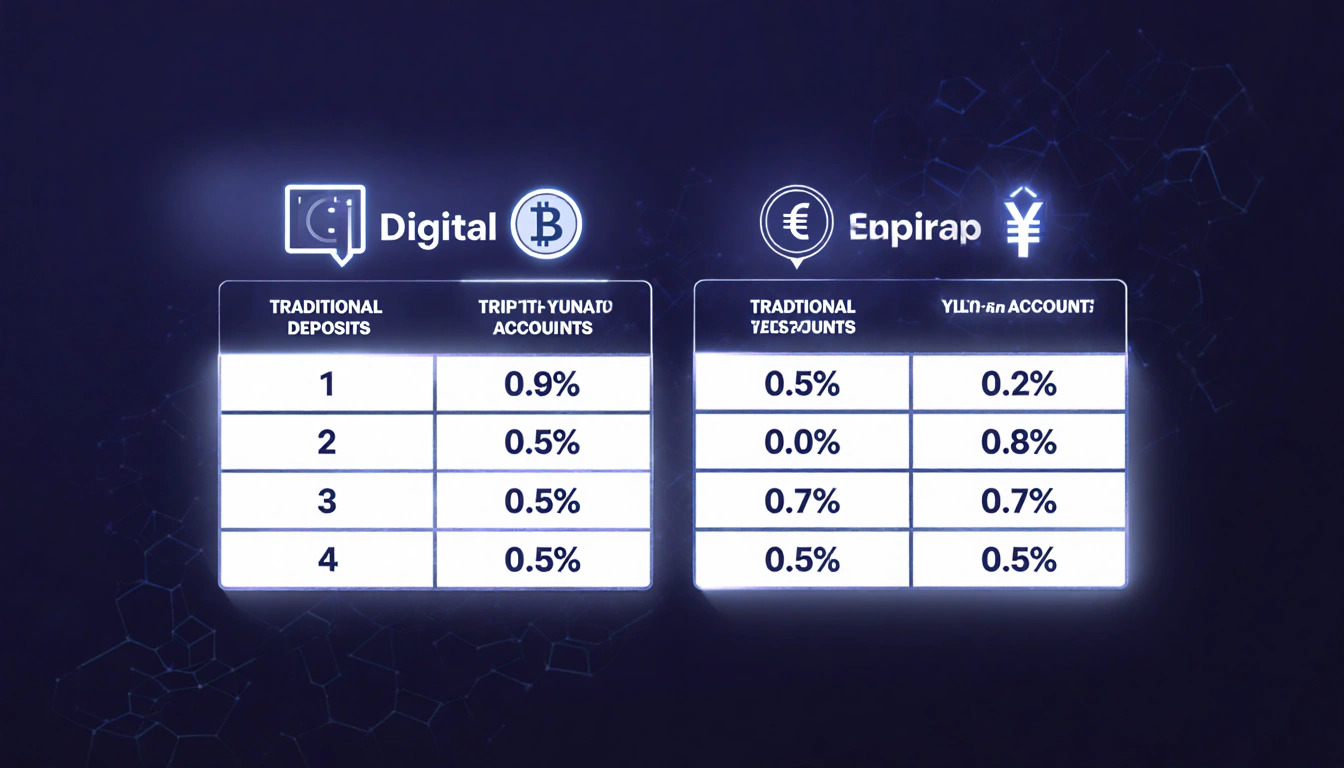

Comparing Rewards: CBDCs vs Stablecoins

While stablecoin users can earn interest through exchanges and other financial institutions, issuers of dollar-pegged tokens may soon pay interest directly, depending on language in the crypto market structure bill expected to be signed by President Trump.

| Currency / Platform | Interest Rate | Availability |

|---|---|---|

| Digital Yuan | 0.05% | Commercial banks |

| Traditional Chinese bank deposits | 0.05% | Commercial banks |

| Stablecoins (USDC / USDT) | Up to 6% | Crypto exchanges |

The People’s Bank of China opened an operations center for the digital yuan in Shanghai in September, and the Chinese Communist Party continues to push for its nationwide rollout.

Key Takeaways

- Digital yuan will earn interest from January 1, matching traditional deposits.

- Current rates are low (0.05%), far below stablecoin rewards (6%).

- The policy is part of a broader five-year plan and coincides with regulatory developments in the U.S. and Europe.

The new interest policy marks a significant step for China’s digital currency, but its real effect will depend on how it compares to the high-yield options available in the crypto market.