At a Glance

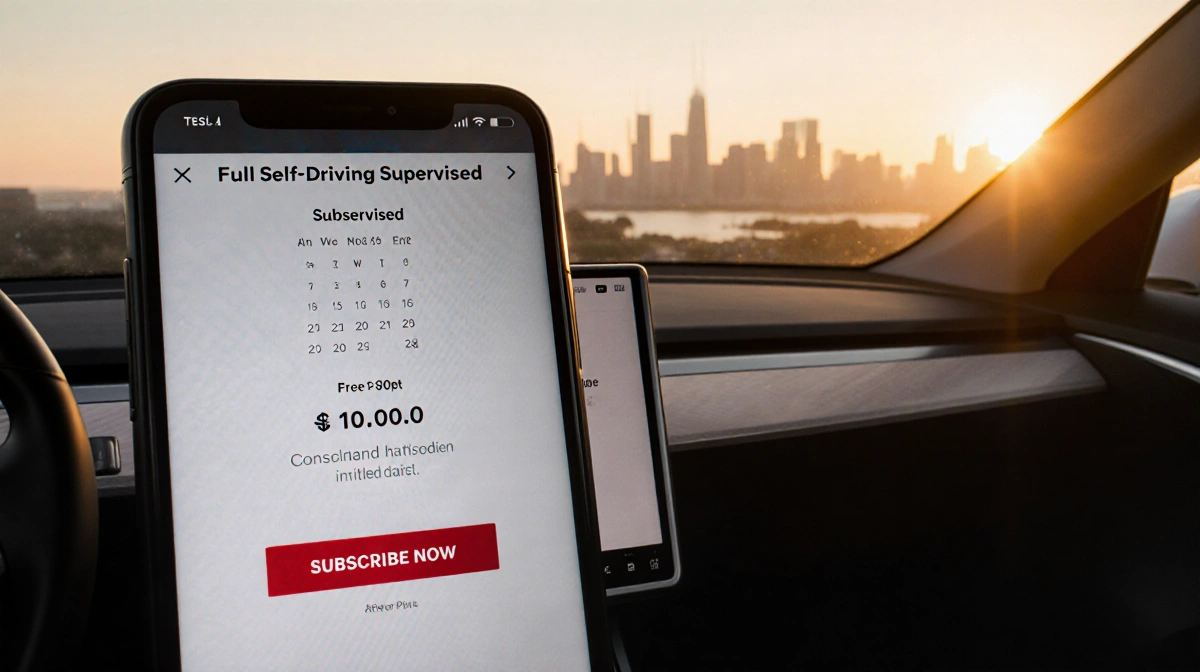

- Tesla will stop selling its Full Self-Driving software for a one-time fee on February 14

- Customers must now pay $99 per month for the driver-assistance feature

- Only 12% of Tesla owners have paid for FSD, prompting the shift

- Why it matters: The move could boost subscriptions and help Musk unlock his $1 trillion pay package

Tesla is ending the option to buy its Full Self-Driving software outright, forcing customers into a subscription-only model. The change takes effect February 14 and could reshape how Tesla earns money from its driver-assistance technology.

Subscription Becomes Mandatory

CEO Elon Musk announced the shift Wednesday on X. Going forward, drivers who want Tesla’s advanced driver-assistance features must subscribe for $99 per month. The company previously charged $8,000 for a one-time purchase.

Tesla first sold FSD as a lifetime purchase. Prices climbed as high as $15,000 in 2022 before dropping to $8,000. Musk often urged buyers to pay upfront, claiming the price would rise as the software improved.

The company added a subscription in 2021 at $199 per month. Tesla cut that price to $99 in 2024, making the monthly option more attractive.

Low Adoption Drives Change

Few Tesla owners have been willing to pay for the feature. Chief Financial Officer Vaibhav Taneja revealed in October 2025 that only 12% of customers have purchased FSD. The subscription model could drive that number higher.

Tesla faces a tough first quarter, and increased FSD subscriptions could provide a revenue boost. Musk gave no details on whether the $99 monthly price will change under the new structure.

Pay Package Incentive

The shift ties directly to Musk’s compensation. His new $1 trillion pay package includes a key benchmark: reaching 10 million active FSD subscriptions measured daily over three months. The deadline is late 2035.

Moving to subscriptions-only could accelerate progress toward that goal. Each monthly subscriber counts toward the total, potentially helping Musk unlock the full value of his compensation plan.

Legal Strategy

The change may also serve as a legal shield. Tesla marketed FSD and its Autopilot system for years with the promise that cars contained all hardware needed for full autonomy.

That claim proved false. Tesla has upgraded vehicle hardware multiple times. Musk admitted that most existing cars with “Hardware 3” will likely need new components.

Customers who bought FSD outright expected their cars to become autonomous through software updates. Tesla has not delivered on that promise.

The company faces mounting legal pressure. In December, a judge ruled Tesla engaged in deceptive marketing around FSD and Autopilot. The California DMV won a case ordering Tesla to suspend its manufacturing and dealer licenses for 30 days.

The DMV stayed the order and gave Tesla at least 60 days to comply. The company must either rename the products or ship software that fulfills its promises.

Multiple class-action lawsuits target Tesla’s autonomous-driving claims. By ending lifetime FSD sales, Tesla caps potential damages if those cases reach trial.

Competitive Landscape

Tesla’s driver-assistance system remains the most capable in the United States. Yet competitors are closing the gap.

Rivian plans its own FSD-like software and will expand its hands-free driving feature geographically. Ford and General Motors offer competing hands-free systems.

Chinese automakers present Tesla’s biggest challenge. Multiple companies develop their own driver-assistance technology, with some including it as standard equipment.

What Drivers Get

Despite its name, Full Self-Driving does not make Tesla cars autonomous. The software provides advanced driver assistance but requires constant human supervision.

Features include automatic lane changes, navigation on highways, and the ability to recognize traffic lights and stop signs. The system can handle some city-street driving scenarios but drivers must remain ready to take control.

Tesla continues developing the technology through over-the-air software updates. The company releases new versions regularly, adding capabilities and improving performance.

Market Impact

The subscription-only model represents a fundamental shift in Tesla’s business strategy. The company will trade large upfront payments for smaller, recurring revenue.

This approach provides more predictable cash flow and could increase total revenue per customer over time. A subscriber paying $99 monthly would spend $1,188 annually.

For Tesla, the change aligns with broader industry trends. Many automakers experiment with subscription features, from heated seats to advanced driver assistance.

The move also reduces Tesla’s exposure to legal claims while creating a path for Musk to achieve his compensation milestones. Whether customers embrace the subscription model remains to be seen.