At a Glance

- $1,000 will be deposited into a new savings account for every baby born during the Trump administration.

- Parents can add up to $2,500 pre-tax each year, with a total cap of $5,000.

- The account is managed by private firms, investing only in U.S. equity index funds with a fee of no more than 0.10%.

- Why it matters: The program aims to give low-income families a chance to build wealth for their children’s futures.

The U.S. Treasury and White House are celebrating the launch of a new savings tool called Trump Accounts. Designed to give $1,000 to every newborn born between Jan. 1, 2025 and Dec. 31, 2028, the money is invested in the stock market by private firms and can be accessed when the child turns 18. The initiative is part of President Donald Trump’s broader push on affordability and the economy.

What Are Trump Accounts?

Trump Accounts are a savings vehicle that invests in U.S. equity index funds. The child cannot touch the money until age 18, and withdrawals are limited to specific uses such as tuition, a first-time business, or a home down payment.

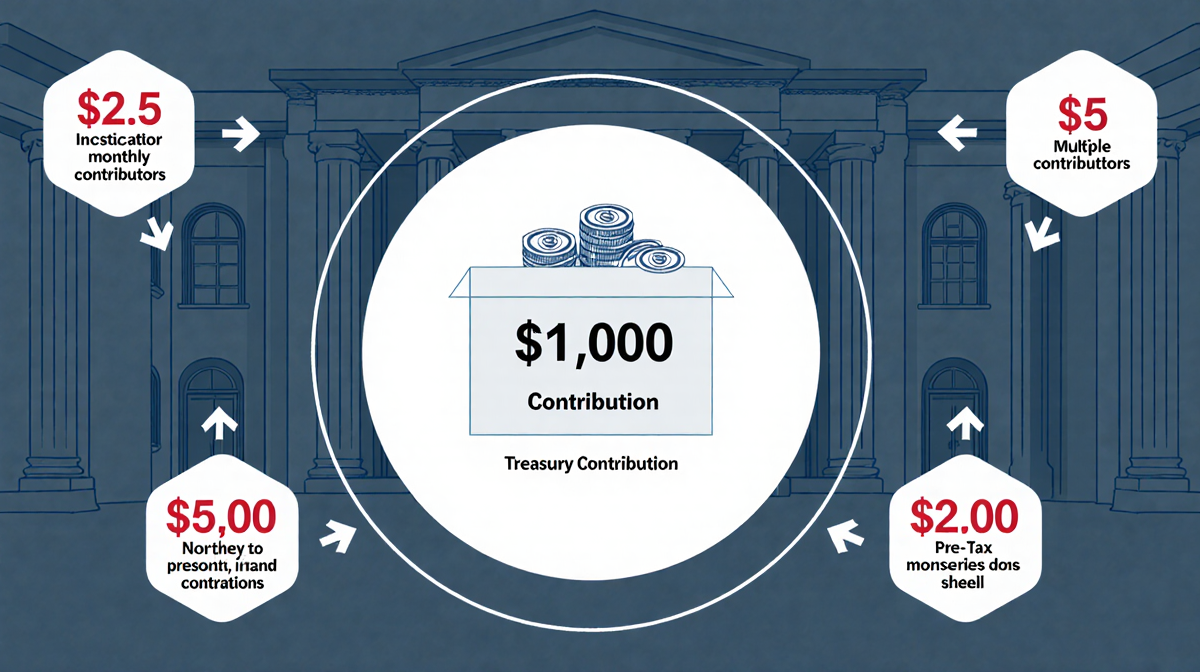

How the Money Is Contributed

- The Treasury contributes $1,000 for eligible newborns.

- Parents may contribute up to $2,500 pre-tax each year.

- Employers, relatives, friends, local governments, and philanthropic groups can also contribute.

- Annual contributions are capped at $5,000, but government and charitable gifts do not count toward that limit.

Investment and Fees

Private banks and brokerages manage the account, investing only in U.S. equity index funds. The accounts carry a fee of no more than 0.10% annually.

Who Qualifies for the $1,000 Seed Money?

The $1,000 bonus is reserved for babies born during the Trump administration. To qualify:

- The child must be a U.S. citizen.

- The child must have a Social Security number.

- The birth must occur between Jan. 1, 2025 and Dec. 31, 2028.

Parents of older children can still open accounts, but they will not receive the Treasury seed money.

Additional Contributions from Philanthropy

In December, Michael and Susan Dell pledged $6.25 billion, allowing children 10 and under in ZIP codes with a median family income of $150,000 or less to receive $250 in seed money if parents open an account.

A week later, hedge-fund founder Ray Dalio and his wife Barbara pledged $75 million for children under 10 in Connecticut, which would translate to $250 for 300,000 qualifying ZIP-code residents.

Other corporate participants include Uber, MasterCard, BlackRock, Visa, and Charles Schwab.

How to Open a Trump Account

Accounts will accept contributions starting July 2026. Parents of eligible children can sign up using IRS Form 4547 when filing taxes this year or when the online portal opens in summer. Registering is required for a child to receive the Treasury money.

The Rationale Behind the Program

Supporters argue that Trump Accounts will:

- Introduce more people to the stock market.

- Provide low-income families a long-term wealth-building tool.

- Reinforce capitalism amid rising popularity of socialist candidates.

According to the U.S. Securities and Exchange Commission, 58% of U.S. households owned stocks or bonds in 2022, but the wealthiest 1% owned almost half of that value.

Critics’ Concerns

Critics say the program:

- Offers little help during a child’s early years, when vulnerability is greatest.

- Fails to offset cuts to food assistance, Medicaid, and other youth-focused programs that were reduced in the same tax bill.

- Could widen the wealth gap, as affluent families can contribute the maximum pre-tax amount, while poorer families cannot.

- With a projected 7% return, the $1,000 seed money would grow to roughly $3,570 over 18 years.

Key Takeaways

| Feature | Detail |

|---|---|

| Treasury seed | $1,000 per qualifying newborn |

| Parent contribution | Up to $2,500 pre-tax per year |

| Total cap | $5,000 per year (excluding government/charity gifts) |

| Investment | U.S. equity index funds, fee ≤ 0.10% |

| Access | At age 18, for tuition, business, or home down payment |

| Eligibility window | Jan. 1, 2025 – Dec. 31, 2028 |

The initiative is dubbed the “50 State Challenge” by Treasury Secretary Scott Bessent, encouraging wealthy donors to pitch in. Whether Trump Accounts will succeed in bridging the wealth gap remains to be seen, but the program has already attracted significant corporate and philanthropic support.

Final Thoughts

The Trump administration’s new savings tool aims to give every child a financial head start. With a combination of Treasury seed money, private contributions, and corporate philanthropy, the program could change the long-term financial prospects of millions of U.S. families-if the investments perform as expected and parents take advantage of the opportunity.