At a Glance

- Kate Bivona and her husband switched to a bronze ACA plan after monthly premiums rose by $300, leaving them with an $18,000 annual deductible.

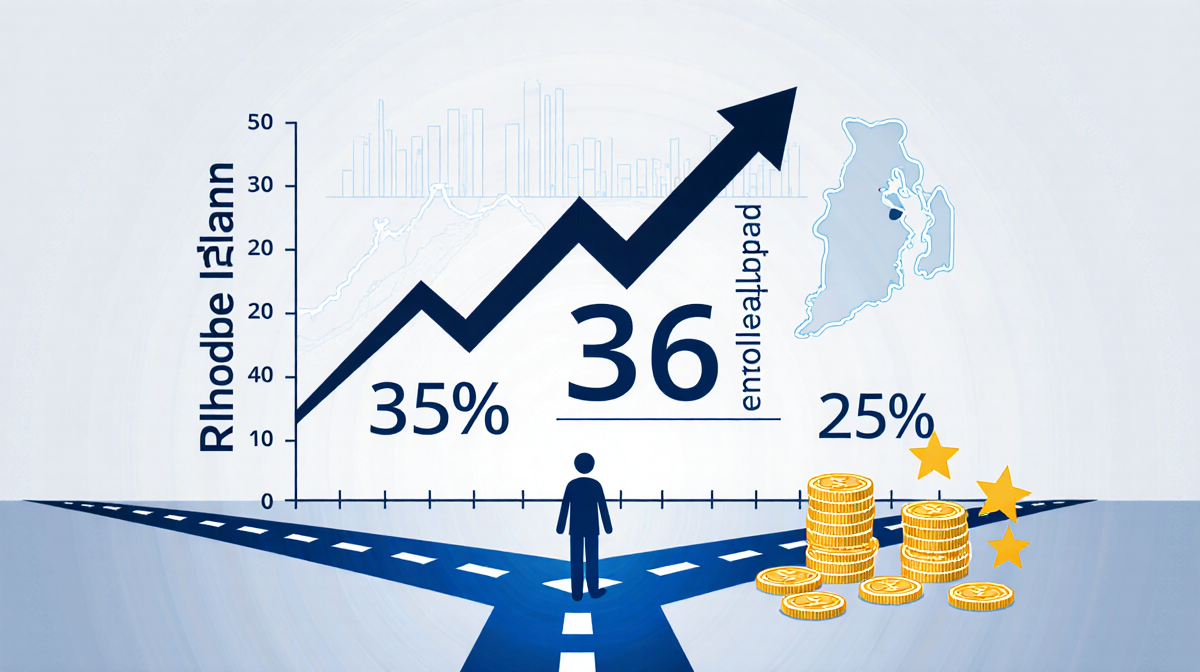

- Bronze plans are gaining popularity in 2026, with 38% of new Rhode Island enrollees choosing the lowest-tier option.

- State data shows silver plan enrollment fell from 53% to 35% and gold from 31% to 25% in Rhode Island.

- Why it matters: The trend toward high-deductible plans may force people to delay care or take on debt, even when they are insured.

Kate Bivona, a 37-year-old musician in Arizona, and her husband had been comfortable with a silver ACA plan until January, when the monthly cost jumped by about $300. They dropped to a bronze plan, cutting their bill by more than half but leaving them with an $18,000 annual deductible. “We would have to take out a loan,” Bivona said. “We don’t have that kind of money, maybe a couple of thousand dollars in savings.”

Rising Premiums Push Consumers Toward Bronze

The Affordable Care Act (ACA) offers four main tiers-bronze, silver, gold, and platinum-each balancing monthly premiums against out-of-pocket costs. Lower premiums come with higher deductibles and copays, while higher premiums reduce those costs. Catastrophic plans, limited mostly to people under 30, account for a small share of enrollment.

The expiration of enhanced premium tax credits at the end of last year pushed premiums higher, forcing many enrollees to prioritize monthly costs over comprehensive coverage. Initial federal open enrollment data shows Obamacare sign-ups down more than 800,000 from last year. State data, which includes plan selections, offers a clearer picture of the shift.

State-Level Trends

State officials report a sharp rise in bronze plan enrollment. In Rhode Island, as of early January, 38% of new enrollees chose bronze plans for 2026, up from 15% two years earlier. Silver fell from 53% to 35%, and gold dropped from 31% to 25%.

> Christina Spaight O’Reilly, communications director for Rhode Island’s ACA marketplace, wrote in an email: “Bronze plan selection is up significantly and silver and gold selection is down significantly for new customers.”

In California, more than a third of new ACA enrollees selected bronze plans for 2026, up from about 1 in 5 last year. Nearly three-quarters of renewing customers who switched plan tiers also moved to bronze coverage.

Other states-Kentucky, Idaho, Massachusetts, New York, and Virginia-reported increases in plan switching, with many moving to cheaper options. Data for Arizona, where Bivona lives, isn’t yet available because it is federal.

| State | Bronze (2026) | Silver | Gold |

|---|---|---|---|

| Rhode Island | 38% | 35% | 25% |

| California | >33% | – | – |

Potential Consequences of the Shift

Health policy experts warn that a broad move toward bronze plans could lead more people to delay care, skip treatment, or take on debt to pay for medical expenses-even though they technically have health insurance.

“If a person suffers from chronic disease or experiences a health emergency, these high-deductible plans push people into bankruptcy,” said Larry Gostin, director of the O’Neill Institute for National and Global Health Law at Georgetown University. “Also, with high deductibles, many people will hesitate to go for diagnosis and treatment. These delays can make patients sicker or even cause deaths.”

The average annual deductible for a bronze ACA plan in 2026 is roughly $7,500 for an individual, according to KFF, a nonpartisan health policy research group. “The idea of the bronze plan was that it would appeal to younger, healthier people,” said Cynthia Cox, director of the program on the ACA at KFF. “You could get a lower premium, you would potentially have a higher out-of-pocket cost, but only if you had a significant health care expense.”

Bivona and her husband fit that profile-they are young, generally healthy, and mostly use insurance for medications and occasional doctor visits. But this year, the decision wasn’t about what plan made the most sense-it was about what they could afford. “It makes me so angry,” she said.

Even with the cash to meet a high deductible, KFF’s Cox noted the coverage still protects people from catastrophic medical bills, such as cancer treatment or serious injuries from a car accident. “The people switching to a bronze plan this year may start to feel like they might as well be uninsured,” Cox added.

What It Means for Consumers

Consumers who choose bronze plans should be aware of the trade-off: lower monthly premiums but higher out-of-pocket costs when care is needed. Those with chronic conditions or those who anticipate medical expenses may face financial strain.

Policy makers and insurers are watching enrollment patterns closely. The shift toward cheaper, high-deductible plans signals a change in how Americans value health coverage-often prioritizing affordability over comprehensive protection.

—

Categories: Health News, Business News